E*TRADE Financial Corporation (NASDAQ:ETFC) today announced results from

the most recent wave of StreetWise, the E*TRADE quarterly

tracking study of experienced investors. Results reveal parents

over-index in their desire to use mobile and emerging technologies to

help manage their portfolios:

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190613005702/en/

(Graphic: Business Wire)

-

Parents are more inclined to demand sophisticated mobile

capabilities: 74% of parents, compared to 59% of the general

population, say their brokerage’s mobile app should deliver

functionality that rivals the web experience. -

They’re more inclined to use wearables: 60% of parents are

interested in wearable technologies to monitor their portfolio,

compared to 39% of the general population. -

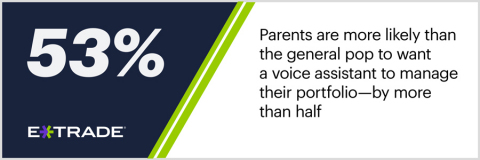

More than half would use a voice assistant or chatbot: 55% of

parents would use a voice assistant, and 54% would use a chatbot to

help manage their portfolio, compared to 36% and 33% of the general

population, respectively. -

Apps have had a positive impact on their investing habits: Almost

three out of four parents (71%) say investing apps have positively

affected their investment experience, compared to 53% of the general

population. -

Parents are more inclined to use social media to learn about

investing: Parents are more likely to use Facebook (35%), YouTube

(29%), and Instagram (28%) to learn about the market and investing,

compared to 24%, 19%, and 17% of the general population, respectively.

“Parents are constantly on the go—not only do they have to balance their

professional and personal lives, they also need to manage their family’s

financial well-being,” said Ed Andersen, Vice President of Mobile and

Advanced Technology at E*TRADE Financial. “The data suggest they crave a

holistic mobile experience, enabling them to do everything from

monitoring the markets and analyzing their portfolio to rebalancing

their holdings and exploring new investment ideas. What’s interesting is

that this bucks the conventional wisdom that mobile should be simple and

focused. While these are certainly important attributes for the parent

population, it’s critical to strike the right balance between being

sleek and streamlined and providing everything this population needs.”

Mr. Andersen also offered the following insights on mobile investing

trends:

-

A leading mobile experience is more than just an app. As smartphone

screens grow larger, the difference between a tablet and a smartphone

is becoming inconsequential. The data suggest that financial services

providers will need to replicate the full web experience on mobile,

whether through more robust app functionality or responsively designed

and quick-loading sites. -

Voice assistants are not a fad. Voice-enabled commands can serve an

important role for parents on the go who may literally have their

hands full. Without ever lifting a finger, a parent can access and

view their account, or even look at the movement of a specific

security. -

Social media has created consumer expectations of micro-communications

wherein snackable content reigns. As more parents turn to social

channels for investing information, financial services companies must

create social content that is appealing for their entire client base.

Social sites can serve real needs beyond simply catching up with

friends and liking photos. Clearly parents want to find actionable and

helpful investing content that is easy to digest while on the go.

E*TRADE aims to enhance the financial independence of traders and

investors through a powerful digital offering and professional guidance.

To learn more about E*TRADE’s trading and investing platforms and tools,

visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the

company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from April 1 to April 11 of 2019

among an online US sample of 917 self-directed active investors (and

includes a sample of 291 parents) who manage at least $10,000 in an

online brokerage account. The survey has a margin of error of ±3.20

percent at the 95 percent confidence level. It was fielded and

administered by Research Now. The panel is broken into thirds of active

(trade more than once a week), swing (trade less than once a week but

more than once a month), and passive (trade less than once a month). The

panel is 60% male and 40% female, with an even distribution across

online brokerages, geographic regions, and age bands.

About E*TRADE Financial and Important Notices

E*TRADE Financial and its subsidiaries provide financial services

including brokerage and banking products and services to retail

customers. Securities products and services are offered by E*TRADE

Securities LLC (Member FINRA/SIPC).

Commodity futures and options on futures products and services are

offered by E*TRADE Futures LLC (Member NFA).

Managed Account Solutions are offered through E*TRADE Capital

Management, LLC, a Registered Investment Adviser. Bank products and

services are offered by E*TRADE Bank, and RIA custody solutions are

offered by E*TRADE Savings Bank, both of which are national federal

savings banks (Members FDIC). More information is available at www.etrade.com.

The information provided herein is for general informational purposes

only and should not be considered investment advice.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or

registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2019 E*TRADE Financial Corporation. All rights reserved.

E*TRADE Financial Corporation and Research Now are separate companies

that are not affiliated. E*TRADE Financial Corporation engages Research

Now to program, field, and tabulate the study. Research Now Group, Inc.

provides digital research data and has locations in the Americas,

Europe, the Middle East and Asia-Pacific. For more information, please

go to www.researchnow.com.

|

Referenced Data |

|||

|

To what extent do you agree or disagree with the following |

|||

| Total | Parents | ||

| Agree (Top 2 Box) | 59% | 74% | |

| Strongly agree | 22% | 31% | |

| Somewhat agree | 38% | 42% | |

| Somewhat disagree | 18% | 18% | |

| Strongly disagree | 23% | 9% | |

| Disagree (Bottom 2 Box) | 41% | 27% | |

|

To what extent do you agree or disagree with the following |

|||

| Total | Parents | ||

| Agree (Top 2 Box) | 39% | 60% | |

| Strongly agree | 14% | 24% | |

| Somewhat agree | 25% | 36% | |

| Somewhat disagree | 22% | 19% | |

| Strongly disagree | 39% | 21% | |

| Disagree (Bottom 2 Box) | 61% | 40% | |

|

To what extent do you agree or disagree with the following |

|||

| Total | Parents | ||

| Agree (Top 2 Box) | 36% | 55% | |

| Strongly agree | 13% | 20% | |

| Somewhat agree | 23% | 35% | |

| Somewhat disagree | 19% | 18% | |

| Strongly disagree | 45% | 28% | |

| Disagree (Bottom 2 Box) | 64% | 45% | |

|

To what extent do you agree or disagree with the following |

|||

| Total | Parents | ||

| Agree (Top 2 Box) | 33% | 54% | |

| Strongly agree | 10% | 16% | |

| Somewhat agree | 24% | 39% | |

| Somewhat disagree | 23% | 21% | |

| Strongly disagree | 44% | 24% | |

| Disagree (Bottom 2 Box) | 67% | 46% | |

|

To what extent do you agree or disagree with the following |

|||

| Total | Parents | ||

| Agree (Top 2 Box) | 53% | 71% | |

| Strongly agree | 18% | 30% | |

| Somewhat agree | 35% | 41% | |

| Somewhat disagree | 21% | 19% | |

| Strongly disagree | 27% | 10% | |

| Disagree (Bottom 2 Box) | 47% | 29% | |

|

What is your preferred social media outlet to learn about the market and investing? (Top 2) |

|||

| Total | Parents | ||

| 24% | 35% | ||

| YouTube | 19% | 29% | |

| 17% | 28% | ||

| 14% | 21% | ||

| 5% | 10% | ||

| Snapchat | 5% | 8% | |

| 2% | 3% | ||

| Tumblr | 1% | 0% | |

| None | 53% | 31% | |

| Other | 7% | 6% | |

View source version on businesswire.com: https://www.businesswire.com/news/home/20190613005702/en/