Home valuation fintech pioneer HouseCanary, today announced the continued review of data from the HouseCanary platform of 45 states and the District of Columbia with sufficient property listing and transaction volume. This issue of Market Pulse compares data between the week ending May 22, 2020, and the week ending March 13, 2020, detailing 22 listing-derived metrics.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200528005263/en/

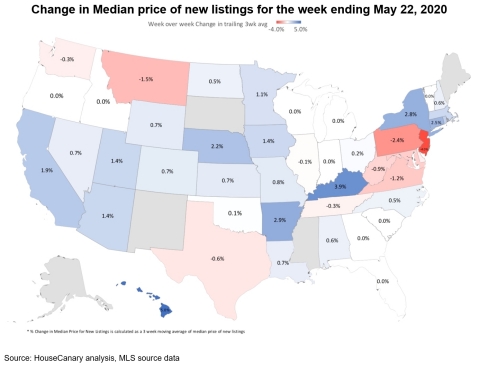

U.S. Map: Week-over-week Change in Median Price of New Listings for Week Ending May 22, 2020 (Graphic: Business Wire)

Nationwide new listing volume of single-family detached homes was down 22.5% compared to the week ending March 13, when most COVID-19 measures were implemented. Although, the data revealed weekly new listing volume is up 21.7% from its lowest level, which occurred during the week ending April 17. Growth in new listing volume has slowed, with weekly new listing volume coming in right around 63,500 per week for each of the past three weeks. Since the beginning of COVID-19, the week ending March 13, through the week ending May 22, there have been 508,273 net new listings placed on the market.

For the week ending May 22, the weekly volume of listings going into contract for single-family detached homes was up 10.5% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented. Since the week ending March 13, a total of 614,702 properties have gone into contract across 46 states. The week ending May 22 marks the second consecutive week in which weekly contract volume was at or above volume for the week ending March 13.

For the week ending May 22, a total of 72,368 home listings went under contract. Weekly volume of listings going into contract is up 73.7% from its lowest level, which occurred during the week ending April 10. Nationwide weekly contract volume has been increasing each week since April 10.

Weekly volume of listings removed for single-family detached homes was down 25.7% nationwide compared to the week ending March 13. This week represents the lowest weekly volume of listings removed throughout all of 2020 so far. For the week ending March 13 through May 15, there are 94,131 fewer properties in total supply than before COVID-19 stay-at-home measures were implemented, driven by an inventory deficiency in 39 of 46 states. HouseCanary notes that since the week of April 5, homes being removed from the market have settled back down to pre-COVID-19 levels.

All this activity has culminated in a tight supply of homes listed for sale and has helped stabilize prices in many markets.

The current supply inventory puts natural upward pressure on new listing prices, and although it’s somewhat counterintuitive during these turbulent times, the median new listing prices continue to rise. Using a three-week moving average, we can see that for 28 out of the 46 states shown in the graphic, median housing prices for newly listed properties are continuing to rise relative to the week prior as we head into summer.

“HouseCanary has been carefully monitoring changes in home sales and listing activity across the country for the nine-weeks since the COVID-19 pandemic impacted business activity and implemented stay-at-home measures,” said Jeremy Sicklick, Co-Founder and CEO of HouseCanary. “This data covers home-sales and listing activity up to the Memorial Day holiday weekend. As the summer months begin, we can see some bright spots in the real estate market with median housing prices of new listings for 28 out of 46 states continuing to rise and over 72,000 properties going under contract in the past week which exceeds pre-COVID levels for the second straight week.”

As a nationwide real estate broker, HouseCanary’s broad multiple listing service (MLS) participation allows us to evaluate listing data and aggregate the number of new listings as well as the number of new listings going into contract for all single-family detached homes observed in the HouseCanary database. Using this data, HouseCanary continues to track listing volume, new listings, and median list price for 46 states and 48 individual MSAs.

HouseCanary will continue to monitor these and other economic indicators for the U.S. housing market and local markets weekly and report results to the news media. HouseCanary is committed to sharing trusted, real-time information given how quickly the housing markets are evolving. For more information about the data that HouseCanary is following, please visit www.housecanary.com.

About HouseCanary:

Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. Learn more at www.housecanary.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200528005263/en/