Joining the magenta fam now means even more green in your pockets. T-Mobile MONEY is the Un-carrier’s no-fee, interest-earning, mobile-first checking account. And starting today, legacy Sprint customers can sign up to score ALL the T-Mobile MONEY benefits, including an industry-leading 4.00% Annual Percentage Yield2 (APY) on balances up to $3,000 — that’s 50 times3 higher than the average U.S. checking account interest rate — and 1.00% APY thereafter. Plus, the Un-carrier is making T-Mobile MONEY even better with cash deposits4 and the ability to get paid up to two days early5 with direct deposit. Since the start of the coronavirus pandemic, many popular savings interest rates have dropped to all-time lows6 yet holding on to your money has never been more critical. T-Mobile MONEY to the rescue.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200824005375/en/

(Graphic: Business Wire)

“Today, more than ever, it’s absolutely critical that people keep more of their hard-earned money in their pockets. T-Mobile MONEY customers get an industry-leading return on their money with zero fees, so they keep more and grow more, the way it should be,” said Mike Sievert, CEO of T-Mobile. “This is just one more way we’re welcoming legacy Sprint customers into the T-Mobile family, and I’m not even close to finished yet.”

During COVID with over 16 million Americans unemployed7 and even more concerned about not being able to pay bills, people are looking for ways to save more and earn more. But big banks are built on fees and next-to-nothing interest rates. Americans paid $34.6 billion8 in overdraft fees alone in 2019. And Bank of America’s Advantage Checking, Chase Checking and Wells Fargo’s Portfolio Checking only offer 0.01% APY9. (This makes Verizon’s microscopic 5G coverage, which customers can connect to just 0.4% of the time, seem big by comparison.)

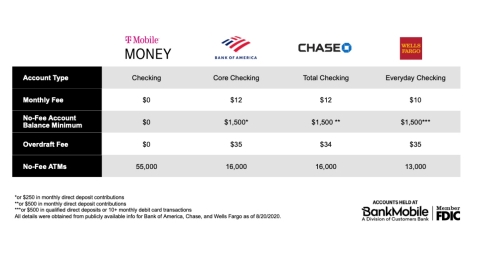

With T-Mobile MONEY, there are no monthly, overdraft, account or transfer fees plus access to over 55,000 in-network Allpoint® ATMs worldwide with no fees10. This is all in addition to offering perks for T-Mobile AND Sprint postpaid customers with eligible service, who can earn 4.00% APY on balances up to $3,000 and 1.00% APY on every dollar over $3,000 when they register with their T-Mobile ID and deposit at least $200 each month. Everyone else, including Verizon and AT&T customers, scores 1.00% APY on all balances, still 12 time3 more than the average bank. And, there’s no minimum balance requirement.

And, because life happens, T-Mobile and legacy Sprint postpaid customers can register for Got Your Back overdraft protection11. These customers can go in the red, up to $50, without penalty — just bring the account back to a positive balance within 30 days to use the service again. This prevents critical transactions up to $50 total from being declined, and with no overdraft fees (big banks penalize customers charging about $30 to $35 per transaction7), T-Mobile MONEY customers have more peace of mind during these challenging times.

Recently-added account features include the ability to make cash deposits at participating merchants — it’s as simple as telling the clerk to add cash to a T-Mobile MONEY debit card. And, when someone sets up direct deposit into their T-Mobile MONEY account, their paycheck can be available up to two days before a traditional bank would give access to their money5.

Welcome to the Magenta Family

Today’s news continues to show legacy Sprint customers more magenta love while welcoming them to the T-Mobile family. Sprint customers can already roam on T-Mobile’s LTE network with access to more than double the number of LTE sites they had before and with a OnePlus 8 5G, LG V60 ThinQ 5G, any of the Samsung Galaxy S20 5G and Galaxy Note20 5G smartphones or the Samsung Galaxy A51 and Galaxy A71 5G, they can tap into T-Mobile’s first and largest nationwide 5G network. Plus, legacy Sprint customers get free stuff and discounts every week from T-Mobile Tuesdays, and new and existing customers can score the best deal in postpaid wireless with four lines of unlimited data for just $25 each per month — free 5G access included. And to protect customers from scams and unwanted robocalls, Scam Shield delivers an unparalleled set of free safeguards.

Get T-Mobile MONEY

To sign up, just download the T-Mobile MONEY app from the Google Play Store for Android 5.1 or later or Apple App Store for iOS 10.3 or later (or use T-Mobile MONEY online at www.t-mobilemoney.com). Sign up directly from your smartphone, and anyone — T -Mobile, Sprint customer or not — can get an account. For personal support, you can sign up in any T-Mobile retail store or by calling 1-866-686-9358. Residents of the 50 U.S. states and Puerto Rico, 18 and older with a social security number can open an individual account.

Mobile-First Everyday Banking

T-Mobile MONEY is mobile-first, that lets people do their daily banking virtually anywhere, anytime right from the app — deposit checks, set up direct deposit, pay bills, send a check or pay with a mobile wallet such as Apple Pay, Google Pay and Samsung Pay, transfer money, instant debit card disabling, pay a bill or pay a friend through person to person payments. The app also offers biometric security through fingerprint and Face ID login, account alerts and debit card disabling.

T-Mobile MONEY also comes with a Mastercard® debit card you can use at more than 55,000 no-fee Allpoint ATMs worldwide—more than Bank of America, Chase or Wells Fargo12 — and you can use the app or website to locate the ATM nearest you. Plus, your T-Mobile MONEY Mastercard offers Mastercard Zero Liability Protection.

T-Mobile MONEY is created in partnership with BankMobile, a division of Customers Bank (Member FDIC), and deposits are FDIC-insured up to $250,000. Customers can get 24/7 bi-lingual customer service and support with T-Mobile MONEY Specialists.

Follow T-Mobile’s Official Twitter Newsroom @TMobileNews to stay up to date with the latest company news.

1TransUnion, July 2020

2 How APY works and what it means for you: As a T-Mobile MONEY customer you earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your checking account per month when: 1) you are enrolled in a qualifying T-Mobile postpaid wireless plan; 2) you have registered for perks with your T-Mobile ID; and 3) at least $200 in qualifying deposits have posted to your Checking Account before the last business day of the month. Deposits posting on or after the last business day of the month count toward the next month’s qualifying deposits. Promotional deposits are not eligible toward the $200 in deposits. If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met. This added value is subject to change. Balances above $3,000 in the Checking Account earn 1.00% APY. The APY for this tier will range from 4.00% to 2.79% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 1.00% APY on all Checking Account balances for any month(s) in which they do not meet the requirements listed above. APYs are accurate as of 8/24/2020, but may change at any time at our discretion. Fees may reduce earnings. For more information, see Account Disclosures / Terms and Conditions or go to our FAQs

3 Based on information provided by the FDIC as of Aug. 24, 2020.

4 Participating merchants charge a fee, in most cases less than $5 per deposit. Fees may exceed this amount and vary by location. We do not set or benefit from fees collected.

5 Depending on the payer’s deposit description, we generally post direct deposits the day they are received, which may be up to 2 days before your payer’s scheduled payment date.

6 Deposit Accounts blog survey

7 U.S. Bureau of Labor Aug. 2020

8 CNBC April 2020

9Smart Asset July 2020 Chase and Wells Fargo Aug. 2020

10 May incur fees from ATM providers when using out-of-network ATMs or international ATMs and from Mastercard when making foreign transactions.

11 Available to T-Mobile wireless customers with a line on an eligible postpaid plan only. Qualified T-Mobile wireless customers must deposit $200 into their T-Mobile MONEY Checking Account within a single month to enable Got Your Back. To count for the current month, deposits must post before the last business day of the month. The $200 can be done as one deposit or in multiple deposits during a month. Deposits posting on or after the last business day of the month count toward the next month’s qualifying deposit. You are only required to meet this deposit requirement once to receive Got Your Back benefits. Promotional deposits will not count towards this deposit requirement. See “Got Your Back” Terms and Conditions for more details.

12 According to bank websites.

5G: Coverage not available in some areas. While 5G access won’t require a certain plan or feature, some uses/services might. See Coverage details, Terms & Conditions, and Open Internet information for network management details (like video optimization) at T-Mobile.com.

About T-Mobile

T-Mobile U.S. Inc. (NASDAQ: TMUS) is America’s supercharged Un-carrier, delivering an advanced 4G LTE and transformative nationwide 5G network that will offer reliable connectivity for all. T-Mobile’s customers benefit from its unmatched combination of value and quality, unwavering obsession with offering them the best possible service experience and undisputable drive for disruption that creates competition and innovation in wireless and beyond. Based in Bellevue, Wash., T-Mobile provides services through its subsidiaries and operates its flagship brands, T-Mobile, Metro by T-Mobile and Sprint. For more information please visit: http://www.t-mobile.com.

About BankMobile

Established in 2015, BankMobile is a division of Customers Bank and among the largest and fastest-growing mobile-first banking platforms in the U.S., offering checking and savings accounts, personal loans and credit cards. BankMobile, named the Most Innovative Bank by LendIt Fintech in 2019, provides an alternative banking experience to the traditional model. It is focused on technology, innovation, easy-to-use products and education with the mission of being “customer-obsessed” and creating “customers for life.” BankMobile employs a disruptive, multi-partner distribution model, known as “Banking-as-a-Service” (BaaS), that enables the company to acquire customers at higher volumes and substantially lower expense than traditional banks. Its efficient operating model enables it to provide low-cost banking services to low/middle-income Americans who have been left behind by the high-fee model of “traditional” banks. Today, BankMobile provides its BaaS platform to colleges and universities and currently serves over two million account-holders at nearly 800 campuses (covering one out of every three students in the U.S.). It is one of the Top 15 largest banks in the country, as measured by checking accounts. BankMobile is operating as the digital banking division of Customers Bank, which is a Federal Reserve regulated and FDIC-insured commercial bank. For more information, please visit: www.bankmobile.com.

About Customers Bank

Customers Bank, a subsidiary of Customers Bancorp, Inc. a bank holding company, is a full-service super-community bank with assets of approximately $17.9 billion at June 30, 2020. A member of the Federal Reserve System with deposits insured by the Federal Deposit Insurance Corporation, Customers Bank is an equal opportunity lender that provides a range of banking and lending services to small and medium-sized businesses, professionals, individuals and families. Services and products are available wherever permitted by law through mobile-first apps, online portals, and a network of offices and branches. Customers Bancorp, Inc.’s voting common shares are listed on the New York Stock Exchange under the symbol CUBI. Additional information can be found on the company’s website, www.customersbank.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200824005375/en/