Released today, the November 2020 LegalShield Economic Stress Index™, a suite of leading near real-time indicators of the economic and financial status of U.S. households and small business, saw its Consumer Stress Index jump to its highest level since April. This suggests that Americans are starting to falter financially after nine months of pandemic-induced stress, creating a sense of urgency for Congress to agree on a new economic stimulus bill that would support consumers until a vaccine is widely available.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201215005786/en/

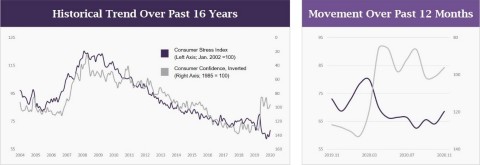

Source: LegalShield v. Conference Board’s Consumer Confidence Index (November, 2004 – November, 2020)

“If the economic plight of millions was previously a blinking yellow signaling caution, our data shows the light has likely turned red and financial collapse is a real possibility for millions of American households without additional economic aid,” said Jeff Bell, CEO of LegalShield. “Many unemployed workers have dropped out of the labor force and housing insecurity is rising across the country. Renters are facing large balloon payments, having deferred rent for months, and small landlords are likewise struggling with mortgage payments. With the rising coronavirus caseload and looming shutdowns in many of the nation’s cities, this could be a dark winter. The only bright spot is in real estate where those who can are upgrading their homes to adapt to the pandemic.”

Highlights from the November 2020 LegalShield Economic Stress Index™ are as follows:

- The Consumer Stress Index, climbed (worsened) 4.4 points in November to 68.6 from 64.2, the highest level since April. Meanwhile, the Conference Board’s Consumer Confidence Index fell 5.3 points to 96.1 in November after two months of gains. Over the last 15-plus years, the Consumer Stress Index’s data intakes has on average led the Conference Board’s Consumer Confidence Index readings by 1 to 3 months.

- The Bankruptcy Index, inched up (worsened) to 31.7 in November from 30.8 in October, though it remains 10.1 points below its February level. Meanwhile, total seasonally adjusted U.S. bankruptcies edged down 0.6% in November and were nearly 40% below year-ago levels. Americans remain cautious about taking on new debt.

- The Foreclosure Index jumped (worsened) 6.5 points to 36.9 in November, the sharpest increase since February. Meanwhile, third quarter foreclosure starts held at an all-time low of 0.3%. As LegalShield data suggest, signs of financial stress in certain areas of the housing market continue to build. For example, data from the Mortgage Bankers Association show that the share of mortgages in forbearance rose to 5.54% (roughly 2.8 million homeowners) in late November, the second consecutive increase. Estimates of broader housing insecurity are also concerning: the Census Bureau’s Household Pulse Survey estimates that nearly one-third of Americans are at least somewhat likely to face eviction or foreclosure in the next two months.

- The Housing Construction Index ticked down from 141.1 to 137.9 in November —the third highest level on record — due to the Foreclosure Index worsening. Meanwhile, housing starts improved 4.9% in October and are up 14% from a year ago, the third month of double-digit annual growth since the pandemic. The homebuilding industry remains a bright spot in the economy and shows few signs of slowing, as increased homebuyer demand — particularly for single-family homes in suburban areas and smaller cities — has driven a sustained resurgence in the housing market.

- The Housing Sales Index increased 2.4 points in November to an all-time high of 116.0. Meanwhile, existing home sales grew 4.3% in October to the highest level in 15 years and are more than 25% above year-ago levels. The current buying spree in the suburbs has continued unabated, fueled by record low mortgage rates and heightened demand for single-family homes. Indeed, the Census Bureau reports that new home sales are also seeing historic demand and were up over 40% Y/Y in October.

The LegalShield Economic Stress Index™

The LegalShield Economic Stress Index™ is comprised of five sub-indices — Consumer Stress, Bankruptcy, Foreclosure, Housing Construction and Sales — constructed from the company’s proprietary data, which reflect the demand for various legal services over the past 15-plus years. Each of the five sub-indices were selected because they tend to lead an existing economic indicator that sheds light on the health of the U.S. economy (i.e., the target economic indicator). Each time a provider law firm, in all 50 states, receives a request from a customer, the request is logged as an “intake” in one of roughly 70 unique areas of law (e.g. – real estate) depending on the nature of the request. The company on average receives 80,000 intakes per month from its 1.8 million memberships, including individuals and small businesses, a statistically meaningful sample. In this way, the data provides actionable intelligence about the near-term direction of the U.S. economy. Keybridge LLC, a boutique economic and public policy consulting firm based in Washington D.C., is responsible for independently compiling and analyzing the LegalShield data and developing the accompanying economic narrative.

About LegalShield and IDShield

A trailblazer in the democratization of affordable access to legal protection, LegalShield is the world’s largest platform for legal, identity, and reputation management services covering more than 4.4 million people. Its IDShield identity theft solution for individuals and families has more than one million members. LegalShield and IDShield serve more than 140,000 businesses. In addition, over 34,000 companies offer LegalShield and IDShield plans to their employees as a voluntary benefit. Both legal and identity theft plans start for less than $25 per month. For more information about LegalShield, visit: https://www.legalshield.com or for more information about IDShield, visit: https://www.idshield.com/.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201215005786/en/