Mogo Inc. (TSX:MOGO) (NASDAQ:MOGO) (“Mogo” or “the Company”), one of Canada’s leading financial technology companies, today announced plans to launch a mobile peer-to-peer (P2P) payment solution that will enable users to quickly and easily make and share payments with friends and family through Mogo’s mobile app. The Company expects to launch the solution in Q1 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200831005321/en/

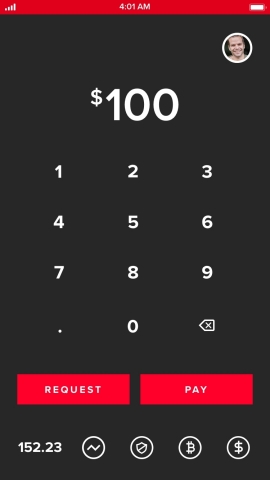

Mogo targeting launch of peer-to-peer payment solution in Q1 2021. This image is for illustrative purposes and may not reflect the final product offering. (Photo: Business Wire)

“As more Canadians embrace the convenience of a cashless life, we expect to see growing demand for mobile, next-generation payment solutions that let users send and receive money instantaneously from their smartphone,” said David Feller, Mogo’s Founder & CEO. “The primary method in Canada today – bank-to-bank transfers using Interac – does not offer the digital user experience consumers now expect as evidenced by the rising popularity of Square’s Cash App, PayPal’s Venmo app and others in the U.S. market. Peer-to-peer payment is a natural extension of our digital platform and will complement and seamlessly integrate with our other products such as MogoSpend, giving our more than 1 million Mogo members even more utility and value.”

Today, Canadians rely primarily on Interac e-transfers for peer-to-peer payments1. In 2019, there were more than 486 million of these transactions totaling $169 billion2. As more aspects of our lives go digital, these numbers will continue to grow and form a larger part of the almost $10 trillion payments landscape in Canada.

Once launched, Mogo’s peer-to-peer payment solution will be accessible through the Mogo mobile app. Users will be able to quickly link their bank account or debit card and then begin sending and receiving money instantly through the app. Today, Canadians can sign up for a free account through the Mogo app and get convenient access to products that can help them achieve their financial goals and have a positive impact on the planet, including a digital spending account with Mogo Visa* Platinum Prepaid Card featuring automatic carbon offsetting, free monthly credit score monitoring, ID fraud protection, bitcoin trading and personal loans.

* Trademark of Visa International Service Association and used under licence by Peoples Trust Company. Mogo Visa Platinum Prepaid Card is issued by Peoples Trust Company pursuant to licence by Visa Int. and is subject to Terms and Conditions, visit mogo.ca for full details. Your MogoCard balance is not insured by the Canada Deposit Insurance Corporation (CDIC). MogoSpend is only available to MogoMembers with an activated MogoCard. MogoCard means the Mogo Visa Platinum Prepaid Card.

1Michael Tompkins & Viktoria Galociova, Payments Canada 2019. Canadian Payments Methods and Trends:2019, 2Bank of Canada designates Interac e-Transfer as a prominent payment system.” Bank of Canada, August 10, 2020. Press release.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of applicable securities legislation, including statements regarding the timing of the launch of Mogo’s mobile peer-to-peer payment solution and its features. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management at the time of preparation, are inherently subject to significant business, economic and competitive uncertainties and contingencies, and may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. Mogo’s growth, its ability to expand into new products and markets and its expectations for its financial performance for 2020 are subject to a number of conditions, many of which are outside of Mogo’s control. For a description of the risks associated with Mogo’s business please refer to the “Risk Factors” section of Mogo’s current annual information form, which is available at www.sedar.com and www.sec.gov. Except as required by law, Mogo disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

About Mogo

Mogo — a financial technology company — offers a finance app that empowers consumers with simple solutions to help them get in control of their financial health and be more mindful of the impact they have on society and the planet. We all know it’s time to do things differently. It’s time for a new way to manage our money, one that’s inclusive and sustainable. One that takes into account our financial health, the planet’s health and the health of our society. At Mogo, users can sign up for a free account in only three minutes and begin to learn the 4 habits of financial health and get convenient access to products that can help them achieve their financial goals and have a positive impact on the planet including a digital spending account with Mogo Visa* Platinum Prepaid Card featuring automatic carbon offsetting, free monthly credit score monitoring, ID fraud protection and personal loans. The Mogo platform has been purpose-built to deliver a best-in-class digital experience, with best-in-class products all through one account. With more than one million members and a marketing partnership with Canada’s largest news media company, Mogo continues to execute on its vision of becoming the go-to financial app for the next generation of Canadians. To learn more, please visit mogo.ca or download the mobile app (iOS or Android).

View source version on businesswire.com: https://www.businesswire.com/news/home/20200831005321/en/