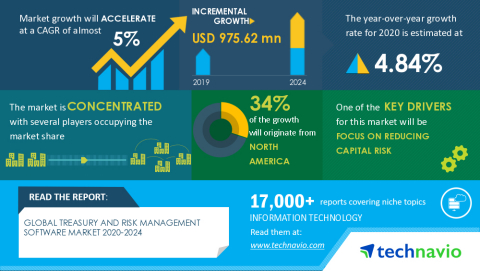

The global treasury and risk management software market size is poised to grow by USD 975.62 million during 2020-2024, progressing at a CAGR of almost 5% throughout the forecast period, according to the latest report by Technavio. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment. The report also provides the market impact and new opportunities created due to the COVID-19 pandemic. Download a Free Sample of REPORT with COVID-19 Crisis and Recovery Analysis.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201030005439/en/

Technavio has announced its latest market research report titled Global Treasury and Risk Management Software Market 2020-2024 (Graphic: Business Wire)

Globally, organizations are focusing on reducing their liquidity or capital risk. To prevent capital losses, organizations have started adopting treasury and risk management software. For instance, in September 2019, Caisse des Dépôts Group opted for Murex’s MX.3 platform to manage its treasury risk and post-trade operations. Furthermore, the treasury and risk management software also offers integration, automation, visibility, and collaboration capabilities that assist treasurers in managing risks and maximizing liquidity. Stringent regulations concerning managing and auditing financial data in organizations are also creating significant business opportunities for the vendors. The treasury and risk management software is helping end-users in complying with the regulations by ensuring systematic flow of treasury reports. These factors are expected to contribute to the treasury and risk management software market growth over the forecast period.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Report Highlights:

- The major treasury and risk management software market growth came from on-premises segment. Companies belonging to the BFSI and healthcare industries deal with critical business- and customer-related information that requires high security. On-premises treasury and risk management software offers high system security compared with the public cloud offering. Large organizations and institutions, mostly in the BFSI and healthcare industries, are the major end-users of on-premises treasury and risk management software.

- North America has a significant presence of end-users such as the BFSI, healthcare, IT, and other industries. Enterprises in these industries are increasingly adopting treasury and risk management software to mitigate issues in managing financial structuring and strategy alignment based on the risk factors in crucial business areas. Moreover, vendors are expanding their product portfolio by integrating their offerings with advanced technologies such as AI, blockchain, analytics, and cloud computing. The US and Canada are the key markets for treasury and risk management software in North America. Market growth in this region will be faster than the growth of the market in South America.

- The global treasury and risk management software market is concentrated. Calypso Technology Inc., EdgeVerve Systems Ltd., Fidelity National Information Services Inc., Finastra, ION Group, Kyriba Corp., Murex SAS, SAP SE, TreasuryXpress Inc., and Wolters Kluwer NV. are some of the major market participants. To help clients improve their market position, this treasury and risk management software market forecast report provides a detailed analysis of the market leaders.

- As the business impact of COVID-19 spreads, the treasury and risk management software market 2020-2024 is expected to have Positive and Superior growth. As the pandemic spreads in some regions and plateaus in other regions, we revaluate the impact on businesses and update our report forecasts.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

Rising Need for Intelligent Treasury Management Software will be a Key Market Trend

The rising need for intelligent treasury management software is one of the significant treasury and risk management software market trends. There is a growing adoption of artificial intelligence (AI) in treasuries. AI-enabled treasury and risk management software can automate identifying risks, assess large volumes of data and generate new types of insights, track financial documents, and evolve chatbots. The intelligent software can also improve fraud detection and productivity. Such factors are creating a significant demand for treasury and risk management software integrated with big data, AI, and machine learning (ML). Identifying lucrative business opportunities, vendors have started forming partnerships, acquiring regional players, and launching new products. As a result of such factors, the treasury and risk management software market size will grow during 2020-2024.

Technavio’s sample reports are free of charge and contain multiple sections of the report, such as the market size and forecast, drivers, challenges, trends, and more. Request a free sample report

Treasury and Risk Management Software Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist treasury and risk management software market growth during the next five years

- Estimation of the treasury and risk management software market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the treasury and risk management software market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of treasury and risk management software market vendors

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

PART 01: EXECUTIVE SUMMARY

PART 02: SCOPE OF THE REPORT

PART 03: MARKET LANDSCAPE

- Market ecosystem

- Value chain analysis

- Market characteristics

- Market segmentation analysis

PART 04: MARKET SIZING

- Market definition

- Market sizing 2019

- Market outlook

- Market size and forecast 2019-2024

PART 05: FIVE FORCES ANALYSIS

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

PART 06: MARKET SEGMENTATION BY DEPLOYMENT

- Market segmentation by deployment

- Comparison by deployment

- On-premises – Market size and forecast 2019-2024

- Cloud-based – Market size and forecast 2019-2024

- Market opportunity by deployment

PART 07: CUSTOMER LANDSCAPE

PART 08: GEOGRAPHIC LANDSCAPE

- Geographic segmentation

- Geographic comparison

- North America – Market size and forecast 2019-2024

- Europe – Market size and forecast 2019-2024

- APAC – Market size and forecast 2019-2024

- South America – Market size and forecast 2019-2024

- MEA – Market size and forecast 2019-2024

- Key leading countries

- Market opportunity

PART 09: DRIVERS AND CHALLENGES

- Market drivers

- Market challenges

PART 10: MARKET TRENDS

- Intelligent treasury management software

- Blockchain in treasury operations

- Growing number of acquisitions and partnerships

PART 11: VENDOR LANDSCAPE

- Overview

- Landscape disruption

- Competitive scenario

PART 12: VENDOR ANALYSIS

- Vendors covered

- Vendor classification

- Market positioning of vendors

- Calypso Technology Inc.

- EdgeVerve Systems Ltd.

- Fidelity National Information Services Inc.

- Finastra

- ION Group

- Kyriba Corp.

- Murex SAS

- SAP SE

- TreasuryXpress Inc.

- Wolters Kluwer NV

PART 13: APPENDIX

- Research methodology

- List of abbreviations

- Definition of market positioning of vendors

PART 14: EXPLORE TECHNAVIO

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201030005439/en/