HouseCanary, Inc. (“HouseCanary”), a leading provider of residential real estate data and home valuations, today released its latest Market Pulse report, covering 22 listing-derived metrics and comparing data between the week ending June 26, 2020 and the week ending March 13, 2020. The Market Pulse is an ongoing review of proprietary data and insights from HouseCanary’s nationwide platform.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200701005315/en/

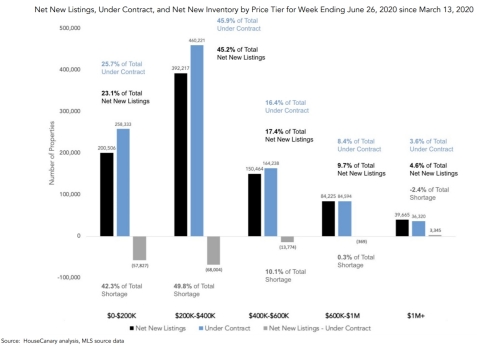

Net New Listings, Under Contract, and Net New Inventory by Price Tier for Week Ending June 26, 2020 since March 13, 2020 (Graphic: Business Wire)

Jeremy Sicklick, Co-founder and Chief Executive Officer of HouseCanary, commented: “The housing market continues to rebound faster and stronger than many analysts and economists predicted at the outset of the pandemic. Despite a gradual rise in COVID-19 cases across the country throughout the back half of June, homebuyers – including many first-time buyers – entered into contracts and followed through on purchases. Resiliency across the market was further implied by drops in listing removals and price cuts. Although the market’s longer-term trajectory remains uncertain due to a variety of factors, ranging from the current health crisis to election year outcomes, the housing sector appears to be on stable ground for the near-term.”

Findings from this week’s Market Pulse report include:

Total Listings Under Contract Since Pandemic’s Full Onset:

- Since the week ending March 13, 1,003,706 properties have gone into contract across 44 states

- For the week ending June 26, there were 73,058 listings that went under contract nationwide

-

Percentage of total contract volume since the week ending March 13, broken down by home price:

- $0-$200k: 25.7%

- $200k-$400k: 45.9%

- $400k-$600k: 16.4%

- $600k-$1mm: 8.4%

- >$1mm: 3.6%

Weekly Contract Volume (Single-Family Detached Homes):

- Up 13.7% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented

- Up 76.2% from the lowest level during the week ending April 10

-

Percent growth in weekly contract volume since the week ending March 13, broken down by home price:

- $0-$200k: +2.8%

- $200k-$400k: +10.9%

- $400k-$600k: +22.4%

- $600k-$1mm: +33.9%

- >$1mm: +40.8%

Weekly New Listing Volume (Single-Family Detached Homes):

- Down 24.4% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented

- Down 8.7% week over week

- Up 19.1% from the lowest level during the week ending April 17

-

Decline in new listing activity since the week ending March 13, broken down by home price:

- $0-$200k: (-27.5%)

- $200k-$400k: (-28.0%)

- $400k-$600k: (-22.6%)

- $600k-$1mm: (-14.3%)

- >$1mm: (-8.8%)

Net New Listings:

- Since the week ending March 13, there have been 867,082 net new listings placed on the market

- For the week ending June 26, there were 52,870 net new listings placed on the market

-

Percentage of total net new listings since March 13, broken down by home price:

- $0-$200k: 23.1%

- $200k-$400k: 45.2%

- $400k-$600k: 17.4%

- $600k-$1mm: 9.7%

- >$1mm: 4.6%

Weekly Volume of Listings Removed (Single-Family Detached Homes):

- Down 27.1% nationwide since the week ending March 13

Weekly Volume of Listing Price Cuts (Single-Family Detached Homes):

- Down 16.5% nationwide since the week ending March 13

As a nationwide real estate broker, HouseCanary’s broad multiple listing service (“MLS”) participation allows us to evaluate listing data and aggregate the number of new listings as well as the number of new listings going into contract for all single-family detached homes observed in the HouseCanary database. Using this data, HouseCanary continues to track listing volume, new listings, and median list price for 44 states and 50 individual Metropolitan Statistical Areas (“MSAs”).

About HouseCanary:

Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. Learn more at www.housecanary.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200701005315/en/