Premier analytics service provider, Quantzig announces the release of its latest success story that highlights how a banking client benefitted from user behavior analytics.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200824005418/en/

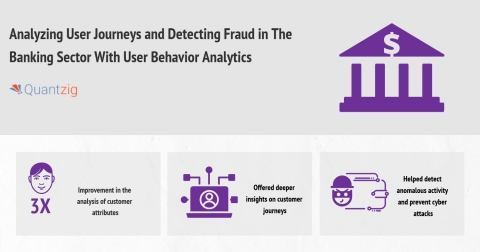

Analyzing User Journeys and Detecting Fraud in The Banking Sector With User Behavior Analytics (Graphic: Business Wire)

Recent success stories that might interest you-

> Customer Segmentation Analytics Helped a Payment Card Industry Client Achieve a 2x Increase in CSAT

The success story serves as a classic example of Quantzig’s customer behavior analytics capabilities. It also offers comprehensive insights into the processes involved in tracking, collecting, and analyzing user data to identify similar patterns in user behaviors. The crux of it, however, stresses on the need for robust user behavior analytics solutions that can offer in-depth insights into end-user behavior to help banking firms better understand customer intentions and track suspicious behavior. Request a FREE demo to understand the potential of user behavior analytics in banking.

Challenges faced by the banking services provider in this case study include-

- The growing need to mitigate risks

- Inability to track user behavior

- A rise in fraud and cyber risks

- Predicaments in introducing new banking services

Over the past 15 years, Quantzig has helped leading banks solve some of the toughest business problems using a unique combination of design thinking frameworks, plug-and-play innovation accelerators, and an army of agile decision scientists. Want to know more? Contact us.

The banking and financial services sector is on the cusp of a major industrial revolution that is driven by the use of user behavior analytics to track and understand customer behaviors effectively. Top banking firms have already succeeded in augmenting their business data with massive customer databases to identify patterns in user journeys, service consumption patterns, and end-user needs. However, there still exists a vast untapped opportunity for banks to develop and integrate an in-house user behavior analytics solution.

We understand the necessity to find realistic ways to track customer behaviors in the banking sector, which is why we help our clients leverage user behavior analytics to track and monitor user journeys effectively. Get your FREE customized proposal to know how Quantzig’s approach can help you make better decisions using customer data.

How did user behavior analytics help the banking services provider?

Quantzig offered advanced and adaptable solutions to analyze user journeys. The process began with a detailed assessment of key business processes and specific requirements of the consumer cards division. This helped the banking client to comprehend the behavior of individual account holders better, calculate risks, and devise strategies to mitigate risks. The user behavior analytics solution also helped the client to-

- Better understand customer journeys

- Achieve a 3X improvement in the analysis of customer attributes

- Detect anomalous activity irrespective of the type of attack

- Read the complete success story for detailed solution insights: https://bit.ly/2EcaSZZ

Besides, these benefits user behavior analytics also enabled them to take definite measures to tackle their challenges by developing an in-house user behavior analytics strategy.

Keep abreast of the emerging trends and best practices in the banking industry by following the latest insights from our big data experts > Follow us on LinkedIn and Twitter.

About Quantzig

Quantzig is a global analytics and advisory firm with offices in the US, UK, Canada, China, and India. For more than 15 years, we have assisted our clients across the globe with end-to-end data modeling capabilities to leverage analytics for prudent decision making. Today, our firm consists of 120+ clients, including 45 Fortune 500 companies. For more information on our engagement policies and pricing plans, visit: https://www.quantzig.com/request-for-proposal

View source version on businesswire.com: https://www.businesswire.com/news/home/20200824005418/en/