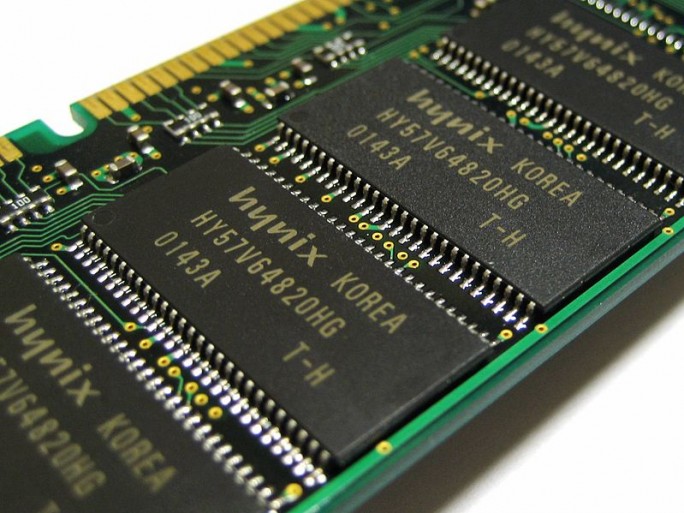

PC dominance in DRAM market slips for first time since the 1980s

No longer hogging the market as post-PC world looms

With sales stalling in many regions, the PC market no longer accounts for the majority of DRAM sales.

According to a research report from IHS iSuppli, the PC market now accounts for 49 percent of DRAM bit shipments, down from 50.2 percent. This equates to the lowest proportion of DRAM sales since way back in the eighties, when the public first started buying into the notion of a personal desktop computer.

Now, of course, the landscape has changed substantially, and it is mobile devices such as smartphones and tablets which are gobbling up DRAM.

While PCs accounted for 55 percent of DRAM sales at the end of 2011, by the end of next year, the market, once dominated by PC sales, will only see 42.8 percent head into desktop use, according to IHS.

This is indicative of the shift in balance to what many have termed the ‘post-PC’ world. Debates about the future of stationary devices may continue to rage from parties on both sides of the argument, but it is clear that mobile PCs will account for more DRAM usage in the future.

Tablet manufacturers will snap up 2.7 percent of the memory shipments in the second quarter, growing to 6.9 percent next year.

Smartphones will see DRAM share rise from 13.2 percent in the second quarter of 2012 to 19.8 percent in fourth quarter of 2013. At this point both mobile devices will account for 26.7 percent of the market.

This will mean a shift in focus for DRAM makers in terms of who they will be selling to, with the status quo of Windows and x86 architecture under threat.

“For DRAM suppliers, the focus in the future increasingly will be on serving the needs of fast-expanding new markets for smartphones and tablets, at the expense of catering to the PC business,” IHS iSuppli analyst Clifford Leimbach said. “This follows other indications of the waning influence of the PC business in the electronics business. Such factors include the declining power of the Wintel alliance, as well as Apple Inc.’s smartphone- and tablet-driven ascendency to chip purchasing leadership above traditional PC-oriented frontrunners like Hewlett-Packard.”